Cable and Wireless Communications PLC (CWC), owners of LIME, has reached a conditional agreement to acquire Columbus International Inc., owners of FLOW, a joint release from both companies said on Thursday.

The proposed acquisition, valued at US$3.025 billion will enable the combined company to significantly accelerate its growth strategy, improve service delivery to customers in the region, offer customers a comprehensive portfolio of high-quality products and services, and strengthen their position against larger competitors,” the release said.

It said the combined business will:

- Deliver broader pro-consumer product offerings and improved services

- Inject state of the art TV and next-generation super-high-speed broadband technology into CWC

- Deliver huge opportunities to the business and government sectors

- Provide rapid lead in fixed mobile convergence through premier network platform

It said the increased scale and capabilities of the combined company will provide the technical platform and financial capacity to help enable CWC to drive greater innovation and expand its geographic footprint.

“The combination of the two companies is consistent with global industry trends, where convergence of fixed and mobile networks, increasing content consumption growth, and continuing development of online applications are driving requirements for high bandwidth, fixed line networks and TV capabilities,” the release said.

It pointed out that operators in Europe and North America, as well as regional competitors, are acquiring and constructing networks that are capable of supporting ever-growing data needs along with new video capabilities.

The combination of the two businesses supports CWC’s new strategy and its four primary areas of focus: drive mobile leadership; accelerate fixed-mobile convergence; reinforce TV Offer; and grow business to business and business to government sectors.

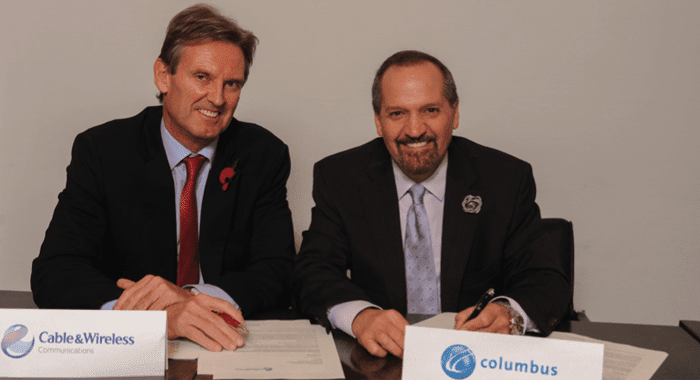

Phil Bentley, CWC’s Chief Executive Officer said, the development is “a transaction that transforms CWC, providing a step-change in growth and returns.

“Columbus offers complementary TV, Broadband and B2B capabilities in complementary markets. Together, we will create the best-in-class quad- play offering in the region, delivered on a superior mobile, fibre and subsea network. This is a significant opportunity to better serve our customers and improve the ICT infrastructure of the communities in which we operate, whilst accelerating our strategy and delivering materially enhanced returns and synergy benefits,” he said.

Columbus’ chairman and CEO, Brendan Paddick said that together the companies will “form a truly world-class company focused on our customers in the Caribbean, Central America and the Andean regions.

“The proposed acquisition makes both companies stronger, faster and smarter in competing with their larger competitors. The proposed transaction reinforces our commitment to transform connectivity in the region, to increase the attractiveness of the region to investors, to support the growth of the communities we serve by making them more globally accessible and to ensure that our customers always have access to the best products and services available,” he said.

The release said that for both companies, the proposed acquisition also enables greater focus on the Caribbean, Andean and Latin American markets as a region that offers attractive growth.

So two companies both with shocking reputations for customer service & product value are to merge.

Why not put LIAT into the mix as well…..

Where is mention of decrease in monthly in the mix for consumers?

Unbelievable. Where are the regulators in the region to stop this deal from going through? This deal would be our worst nightmare come true. Remember when Cable and Wireless use to over charge and under deliver? Incase you don’t know they call themselves Lime now. They are the worst company I have ever seen operate and this after witnessing Rogers in Canada and Comcast in the states, Cable and wireless (Lime) is worst than any I have seen. And now they are buying the competition and monopolizing the IT industry in the region.

Where are all the Prime Ministers and Telecommunication ministers in the region? This is sickening stuff. If the deal is going to go through at least let them spin off the retail section from the trunking sections of the company that does the backbone trunking for the region. Sometimes I cannot believe what comes out of the Caribbean. It’s time you all stop voting in people who know how to look and sound good and put people in office that know what they are doing and that goes for SVG. All other parts of the world are leaving us behind in the IT sector and you all are going to allow this??

Muddawuk

I now understand why those two men are smiling in the picture,they know that with a purchase consideration of US$3.025 billion,they have createD a new monster that is going to feed on the poor victims of the Caribbean region.They know the feast is coming

The release failed to say that this acquisition will enable Cable and Wireless to milk Vincentians and other consumers throughout the region all over again.

Will the Gonsalves goverrnment try to block this merger in the name of fostering competion? “Independent” SVG simply doesn’t have the political clout to stop a merger that will inevitably result in much higher prices and lower services for consumers.

Remember when C & W monopolised tele-communication in SVG? Here we go again.

The roots of the three main providers for commercial communication in this country are fixed-line, cable, and wireless. In terms of service delivery to customers for the internet they all struggle with high traffic, enforced by their promotion and the political demand to grant access for everybody. The customers will hardly get the megasamplespersecond they pay for, maybe only early in the morninig about 2am to 4am.

The problem for the providers is obviously, to cover the costs of this development.

Let us wait and see, if the merger of the providers of fixed-line and cable will indeed provide improved service delivery, without increasing the price.

this merger is utter NONSENSE FYI ppl if karibe cable now flow customers wanted to use lime services they would have not gone to karibe cable. lime u done sour like lime so what u trying proof. I hope customers will have a say in this merger. u know when ppl see money them face does light up like a Christmas tree. I am supposed to go back to karibe cable services next year but them sold out to flow so me bin gone go flow but this merger with soury lime change me mind. hear what if alyo put the Internet price for $20ec me na go mind if not hit the road lime and flow and don’t come back