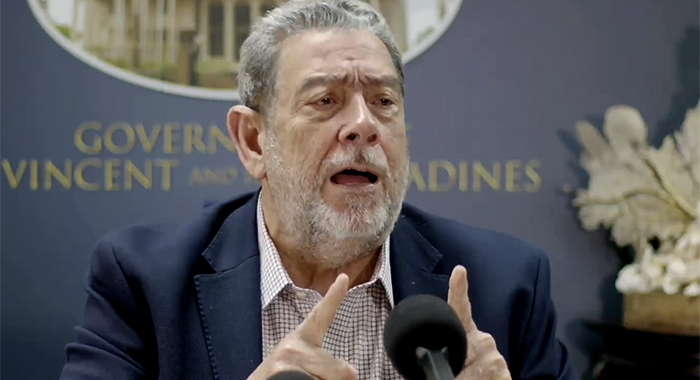

Despite the urgent need for reform of the National Insurance Services (NIS), Prime Minister Ralph Gonsalves says the social security “is, remains and will be by far the best investment that any working person can make with their money”.

He made the assertion on Tuesday as he presented “the unvarnished facts” about the 36-year-old social security that must be reformed by next year if it is going to continue to function beyond 2034.

“What are the unvarnished facts about the NIS? And I want the working people to hear me. Today, tomorrow and with the reforms which are going to be instituting, the NIS is, remains and will be by far the best investment that any working person can make with their money,” Gonsalves told a press conference in Kingstown.

“You want me to repeat that? The NIS is, remains and with the reforms will be, will continue to be, the best investment, by far, that a working man and woman can make.”

He said that on average, Vincentians will live some 15 years after retiring.

“… at the lower level of the income scale, you get back between 18 months and two years all the money that you put in. And at the higher level, between three to four years …” the prime minister said.

However, Derek Osbourne, the actuary, told a panel discussion in Kingstown, on Wednesday, that while he was not sure how many people get their NIS investment back in two years, it “might be 10, 15%”.

“But a few people are getting money back very quickly,” Osbourne said, adding that for the people who contributed the highest amount to the NIS, it would take about 15 to 20 years for them to get back in pension what they contributed.

Gonsalves, who is 78, said he is “unlikely to be around in 2034”, when, based on the current structure of the NIS, it will be in difficulties.

“I could sit back and say ‘well that ain’t my problem I wouldn’t be around here.’ But I’m a responsible person. I have to look ahead so that the reforms which you will have to make then would not be reforms which will hurt you,” the prime minister said.

“And if I’m not around, ants will bring the news to me and tell me people saying praise God, that Ralph did institute the reforms,” he further stated, using a colloquial expression meaning that ants would bring news to him in the afterlife.

Gonsalves said another truth is that the NIS, under the political leadership of his Unity Labour Party and Stuart Haynes, the executive director and Reginald Thomas before Haynes, “ has been a well-run organisation.

“You’re not going to have any perfect organisation. It is a well-run organisation,” he said.

He spoke to the structural challenges facing the NIS as well as social security agencies in Barbados, Grenada, Antigua, Jamaica, France, United Kingdom, at different ways and at different levels.

“And you have to have the leadership courageous enough to do the reforms,” the prime minister said, adding that the first issue was that the NIS was generously designed, both in terms of low contributions and huge benefits.

He noted that under the National Provident Fund, the precursor to the NIS, which was established by the Milton Cato administration in 1975, the contribution rate was 10% shared equally between employer and employee.

However, when the NIS was introduced in 1987 under the NDP administration, the rate was set at 5% — 3% by the employer and 2% by the worker.

“St. Lucia kept theirs at 10%. 1987 to now is 36 years … And we only recently went up to 10%,” he said, adding that despite this, a Vincentian worker will get up to 60%of their insurable income as pension, while other systems give 50%.

As a sickness benefit, Vincentian workers get 60% of their insurable income.

“Generously designed both in relation to the contributions you have to pay and in relation to the benefits what you’re getting,” the prime minister said.

He said the second point is that “structurally, when you have an NIS which is not yet mature and it’s now in a stage of maturation, you had more people making contributions than people retiring because the system was young.

“But as the system matures, now 36 years, you have more retirees per contributor.”

He said an additional issue that comes with the maturation of the system is the demographics.

“People are living longer and the growth of the population is slowed so that over time, you will have … fewer young people coming on to the system as contributors than those retiring. “

The prime minister said that between the 2001 and 2012 censuses, the over 60 population increased by over 30%, the highest increase in any sector of the population.

“It is true that still the largest cohort of people are under 30. But the growth of that is far less than the growth of the older population,” he said.

Gonsalves said that as the NIS matured and with the aging of the population, the contribution income was not able to pay all the benefits.

“So, you have to now go from contribution income, you have to go to investment income. And that’s fine …” GOnsalves said, adding that the NIS has assets of about EC$500 million but cannot invest that money only in St. Vincent and the Grenadines.

“You can’t put all your eggs in one basket. You have to invest your money overseas including in what do you make all blue-ribbon companies, real big companies and you have to invest them in bonds, safe money like in the US because you have to balance returns and the yield and you have to balance it with security.”

He, however, said that the NIS lost money on its investments overseas because of downturns in the US market.

“And its local investments, though they helped, especially money which the government, through bonds, government bonds, borrowed, they made money on those but those monies were not sufficient to offset the losses on investments overseas.”

As a result, last year, the NIS had to go into reserves to get money.

“But in the first half of this year, the investment climate overseas has improved. So, the first half, it went up by about $10 million. I saw the reports for the first half as against what was done in the previous year, two point something million so there’s a net of seven point something million.”