By Kenton X. Chance

ABUJA, Nigeria (CMC) — Professor Benedict O. Oramah on Friday ended his 10-year stint as president and chairman of the board of directors of the Egypt-based African Export-Import Bank (Afreximbank), hailing the financial institution’s expansion to the Caribbean over the last four years.

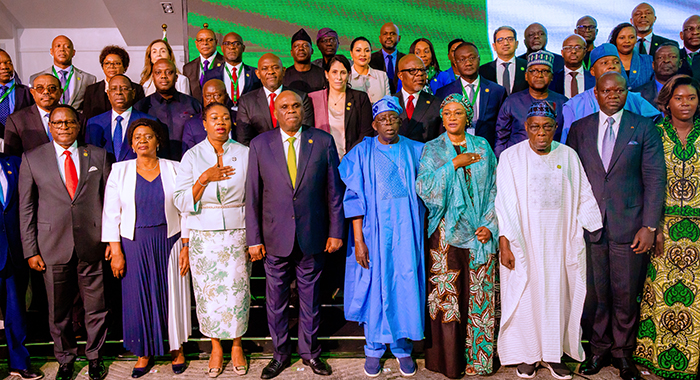

“The array of political and business leaders who have joined us from the Caribbean speaks volumes regarding the progress we have made with our outreach to our friends, brothers and sisters in the CARICOM,” he said at the 32nd Afreximbank Annual Meetings (AAM2025) that ends here on Saturday.

“Over the past four years, we have significantly advanced commercial and cultural linkages within Global Africa,” he said, referring to the concept that recognises people of African descent the world over as part of Africa.

The annual meetings are being attended by the Prime Minister of The Bahamas, Phillip Davis, as well as his St. Kitts and Nevis counterpart, Dr. Terrance Drew and Grenada’s Dickon Mitchell.

The Secretary General of the 15-member CARICOM, Dr. Carla Barnett, Grenada’s Attorney General, Minister for Legal Affairs, Labour and Consumer Affairs, Claudette Joseph, former Jamaica prime minister, PJ Patterson and the chief executive officer of the Barbados-based CARICOM Development Fund (CDF), Rodinald Soomer, are also attending and made interventions at AAM2025.

“Our successful outreach within the Caribbean has led to 12 CARICOM states becoming partner members of the bank, with the 13th scheduled to join next week,” Oramah said, but did not name the country.

On the opening day of the conference on Wednesday, acting head of Afreximbank in the Caribbean, Okechukwu Ihejirika, told Caribbean reporters covering AAM2025 that Afreximbank is interested in doing business in all CARICOM countries.

“So the business is ramping up progressively and I’m happy as well to say, hopefully we should welcome the other big islands, in terms of Jamaica and Trinidad and Tobago, to complete the fold that we’ll have the full complement of the Caribbean available for us to service,” he had said.

During his wide-ranging speech, Oramah noted that the establishment of the Afreximbank Caribbean Office in Bridgetown and the subsequent groundbreaking in March for the construction of the bank’s African Trade Centre there, which would become the first outside of Africa.

He said that other notable achievements include the establishment of the Africa-Caribbean Business Council (ACBC) and the launch of the AfriCaribbean Trade and Investment Forum (ACTIF) in 2023, with this year’s edition scheduled to take place in Grenada from July 28 to 29.

“On the business front, your bank has approved and disbursed millions of US dollars and disbursed millions of dollars to The Bahamas, Barbados, Grenada, Guyana and St. Lucia.”

He said In Suriname, Afreximbank is coordinator and a mandated lead arranger of a syndicated US$1.6 billion facility to the state oil company, Staatsolie, for their acquisition of a significant participation in the major oil discovery made there by French multinational integrated energy and petroleum company, Total Energies SE.

In Guyana, Afreximbank is working with the authorities to implement a one billion US dollar Local Content Support Facility to boost the domestic impact of the significant oil production there.

“Afreximbank is also working with the Caribbean Development Fund, the first CARICOM shareholders of the bank, to introduce a Resilience and Sustainability Facility for the CARICOM,” Oramah said.

He recognised and thanked the strong contingent of political and business leaders attending the annual meeting from CARICOM.

The annual meetings had come full circle, having been held at the same hotel where they were first held in 1993, about the same time that Oramah, a Nigerian who holds doctoral and master’s degrees in agricultural economics from Obafemi Awolowo University in Nigeria, joined the bank.

Oramah said that when the new president is appointed on Saturday, Abujah would make history as the city where three of Afreximbank’s four presidents were appointed.

He noted that in June 2015, in Lusaka, Zambia, shareholders elected him unanimously as Afreximbank’s third president.

Oramah said that in his acceptance speech, he made a solemn promise to shareholders to ” deliver a solid bank that will be a leader among its peers in all measures of financial performance”.

He had also promised to grow quickly the capital of the bank in absolute terms, improve capitalisation through innovative capital management initiatives, ensure first-class risk management, and achieve adequate returns to shareholders

Oramah also detailed the other commitments he had made then, adding that he had said there would be no sacrifice too great for him to make “for a bank that saved my life.

“I stand before you most pleased and fulfilled that I kept my promises. I gave the job the best of my energy, intellect, courage and determination,” Oramah said.

He told the annual meeting that as a result, between the 2020, the onset of the COVID-19 pandemic, and May 2025, and with the strong support of shareholders, Afreximbank invested approximately US$120 billion in Africa and the Caribbean and US$155 billion during the last decade.

“These must rank among the highest, by any standards. We have collectively, over the past decade, built a solid financial institution that is good for Global Africa.”

He pointed out that Afreximbank’s total assets and guarantees grew more than eightfold between September 2015 and April 2025, to reach US$43.5 billion.

Total revenues also rose sevenfold, reaching US$3.24 billion, up from US$408 million in 2025. Net income amounted to about US$1 billion in 2024, about 700% increase from its level of US$125 million in 2015.

Internal capital generation and very strong support of shareholders through significant additional equity investments saw shareholders’ funds rise from about US$1 billion in September 2015 to US$7.5 billion in April 2025, with callable capital reaching US$4.5 billion, up from US$450 million in September 2015.

Oramah said that liquidity remained strong, with sources of funding much more diversified in 2024 than in 2015, due to activities of the Africa Resource Mobilisation Unit, which saw the share of African sources of funding rise from 11.7% in 2015 to 36.6% in May 2025.

He told the annual meeting that despite the challenging operating environment, the Bank Group was able to continue with the tradition of returning value to shareholders through annual dividends distributions.

Aggregate dividend payments from 2015 to 2024, reached US$1.35 billion.

“Today, Afreximbank has become the trusted institution for mitigating the adverse impacts of economic shocks and the primary source of vital medium- to long-term financing for the African private sector and critical sectors of the African economy,” he said.

The outgoing president pointed out that the trajectory of growth and relevance did not start with him, but goes back to my predecessors, who grew the Bank multiple-folds from where they took it.

He said this is why he regards Afreximbank at no less than US$250 billion in total assets and guarantees in 10 years, when his successor’s tenure will be ending.

“I have no doubt that we would see that given the strength, depth and scope of the Bank Group today. And we must support and work towards the attainment of that vision, because it is by our owning and controlling a bank of that size that Africa can hope to escape from the shame of poverty and underdevelopment,” Oramah said.

He said he was impressed by the rigour with which the Board of Directors selected the candidate they are recommending to shareholders as his successor.

“I urge you all to continue your strong support for the Bank and its new leadership, post my exit from your great bank,” Oramah said.

During Friday’s ceremony, President of Nigeria, Bola Ahmed Tinubu conferred Oramah with Grand Commander of the Niger, the second highest honour in Nigeria.