Financial literacy in the Eastern Caribbean Currency Union is generally low, but lowest in St. Vincent and the Grenadines (SVG).

These were the findings of the Eastern Caribbean Central Bank’s (ECCB) Financial Literacy and Financial Inclusion Survey, the results of which were published recently.

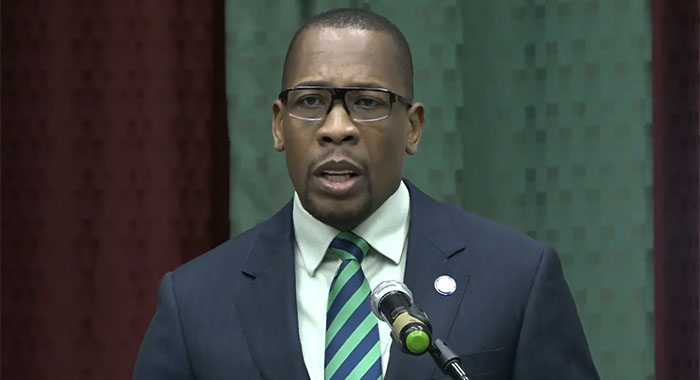

“In a region which boasts high levels of adult literacy (high 90s), financial literacy is lamentably low and lugubrious,” Timothy N.J. Antoine, governor of the ECCB told the launch of the survey results.

“How do we explain the following? Persons engaging in hire purchases ignorant or indifferent to effective interest rates with some as high as 35%. The proliferation of payday loans which essentially means attempting to ride up on a down escalator — a veritable debt trap,” Antoine said.

He also asked why highly credentialed persons are clueless about managing their personal finances.

The ECCB governor also pointed out that only 1 in 25 persons (4%) in the ECCU are invested in the regional and international capital markets but several persons are now pursuing investments in high risk cryptos.

Antoine further said that people are spending their limited income on wants while begging family, friends and government for their basic needs.

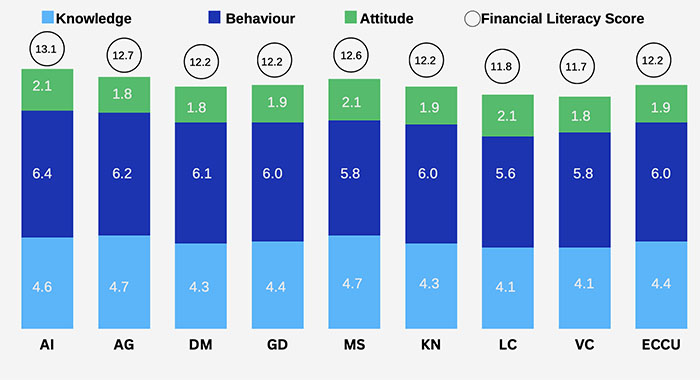

The financial literacy score was obtained by adding the scores of financial knowledge (range from 0 to 7), financial behaviour (range from 0 to 9) and financial attitude (range from 0 to 4).

The derived financial literacy score ranges from a minimum value of 0 to a maximum of 20, with a score of 20 suggesting that an individual has acquired a basic level of understanding and use of finance.

The ECCU is comprised of Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, St. Lucia, and SVG.

The Financial Literacy and Financial Inclusion Survey found that overall financial literacy score across the currency union was 12.2 out of a maximum of 20 or 61%.

In the ECCU, the financial literacy score ranged from 11.7 to 13.1, with Anguilla achieving the highest score and the lowest score by SVG.

The other six countries scored between 11.8 (St. Lucia) and 12.7 (Antigua and Barbuda).

“There is a need for improvement in financial knowledge, behaviour and attitude in the ECCU,” the report said.

The ECCU financial behaviour score was 4.4 out of 7, representing 62.2 per cent of the maximum possible score.

Three in five adults met the minimum target score of 6 out of 9 for financial behaviour.

The ECCU financial knowledge score was 6 out of 9, representing 66.5% of the maximum score possible.

Half of all adults met the minimum target score of 5 out of 7 for financial knowledge.

The ECCU financial attitude score was 1.9 out of 4, representing 47.6% of the maximum score possible.

Only one in five adults met the minimum target score of 3 out of 4 for financial attitude.

The survey also found that financial product awareness was relatively high while use was relatively low across the ECCU.

Financial Inclusion provides insights into the extent to which respondents are active financial consumers. In this exercise, financial inclusion is measured by respondents’ awareness, holding/choice and use of financial products,” the report said.

Product awareness was relatively high across all countries; however, the use of these products was relatively low.

The survey results show that 88.3% of respondents were aware of at least 5 of 18 financial products, while 54.5% chose at least one of these products in the two years preceding the survey.

Product awareness was highest in Montserrat and lowest in SVG. Meanwhile, Anguilla had the largest number of persons who recently bought a financial product.

Antoine said the ECCB commissioned the survey because financial inclusion is a strategic priority.

Financial inclusion refers to access to a range of financial services including banking, credit and insurance.

He noted that Investopedia defines financial literacy as the ability to understand certain financial issues and use financial skills for personal financial management such as budgeting and investing.

“This latter behaviour calls to mind a remarkable observation by the late Martin Luther King Jr. who in the 1960s observed that many black people were spending money on their wants and then begging for their needs,” Antoine said.

“Against this backdrop, this survey is no ordinary survey and cannot be an academic exercise. Indeed, urgent action is needed to address financial literacy and inclusion in the ECCU,” he said.

Notwithstanding low financial literacy scores across all ECCU countries, some components of financial literacy saw better results than others.

For instance, 3 in 5 individuals or 61.6% of respondents achieved the minimum target score for financial behaviour.

Results deteriorated across the other two components of financial literacy as 1 in 2 individuals or 50.5% of respondents achieved the minimum target score on financial knowledge.

A mere 1 in 5 individuals or 18.8% of respondents achieved the minimum target score on financial attitude. Across all three components, 8.6% of individuals achieved the minimum target score.

At the country level, the proportion of respondents passing the minimum target financial behaviour score ranged from 56.6% in St. Lucia to 71.9% in Anguilla.

Similar results were seen for financial knowledge, where the proportion of respondents passing the minimum target was lowest in St. Lucia (41.8 %) and highest in Anguilla (62.3 %).

Contrary to the pattern seen for financial behaviour and knowledge, 14.5% of respondents in SVG passed the minimum target financial attitude score, while Montserrat had the highest proportion of persons (24.4 %) passing the minimum target financial attitude score.

ECCU trying to raise financial literacy levels

Antoine said that over the past 21 years, the ECCB has sought to raise the level of financial literacy through its saving and investment courses, annual Financial Information Month and its weekly podcast, ECCB Connects, which began airing seven years ago.

He said it was time for a strategy to scale up

“We live in a shock-prone world. As a region vulnerable to external shocks, we must be engaged in a lifelong pursuit of building resilience including financial resilience. This is imperative for member countries, companies and individuals. The survey reveals that 1 in 2 persons in the ECCU are not financially resilient.”

Antoine spoke of financial resilience as the capacity to absorb and bounce forward from a shock such as a health event, a job loss, an economic downturn, a natural disaster or even a pandemic.

“Let’s face it, there persons in the ECCU who have experienced all these shocks during the past five years,” he said, adding, “When it comes to our personal finances, we must hope for the best but plan for the worst. Never forget, hope is not a strategy.”

He said that every citizen should aspire to be financial literate and resilient.

“Armed with the results of this survey and seized with a sense of urgency, I issue a clarion call for a coalition of partners and champions (institutionally and individually) to join the ECCB as we craft and implement a strategy to scale up financial literacy and inclusion in the ECCU.”

He said the mission of the ECCB is “to advance the good of the people of the currency union” where they do not merely strive but thrive.

“Could you imagine what our Currency Union would be if every citizen were financial literate? We would be thriving,” Antoine said.

“Could you imagine if every high school graduate in the ECCU were financially literate? To achieve this, we need our Ministries of Education and the Caribbean Examinations Council to make this outcome a high priority.

“Could you imagine the improvement in mental health, financial resilience and wellbeing if more of our people are capable of managing their personal finances?

“Could you imagine if every workplace starting with governments (the largest employers) offered financial wellness programmes?

“That would be a new day and a giant stride in our big push for financial resilience and wealth creation.”

Antoine said this is a cause worth pursuing with huge potential dividends.

“As a region, we cannot change our history nor can we change our geography but collectively we can elevate our development trajectory through innovation and collective action. Let us seize the moment and may God crown our efforts with resounding success,” he said.

Make financial literacy a separate course in classrooms?

We are nation of chronic dunces in a region of semi-literate dunces thanks to our “education revolution” that built more fancy schools and hired more poorly trained teachers pretending to impart indifferent students from dysfunctional homes with a constantly dumbed-down curriculum so as to fool the public into thinking they were actually internalizing the wisdom of the ages.

Our “15 subject” graduates are far below the level of our eight subject graduates 50 years ago in knowledge, reasoning, and comprehension.