The new minister of Finance in St. Vincent and the Grenadines is maintaining the policy of the ruling Unity Labour Party against a citizenship-by-investment (CBI) programme for the country.

SVG remains the only of the five independent Organisation of Eastern Caribbean States member nations without a CBI programme, also called economic citizenship.

However, Gonsalves said that contrary to being the economic magic wand he said the opposition New Democratic Party was making out CBI to be, there is a strong correlation between CBI programmes and OECS countries having to undergo restructuring imposed by the International Monetary Fund.

Gonsalves, who became Minister of Finance last November, was responding in Parliament last Thursday to a question from opposition lawmaker St. Clair Leacock.

Leacock, who is Member of Parliament for Central Kingstown, said the Government of SVG’s position on the “elsewhere” and otherwise referred “we nah sell passports” policy with reference to CBI programmes is fully understood even though not appreciated.

“This is against the background of consistent earnings in or around half a billion Eastern Caribbean dollars per annum in the sister islands of Grenada, St. Lucia, Dominica and St. Kitts and Nevis.

“To the extent we have, in principle, rejected this large revenue stream, please explain the justification of the following budgeted schedule of local and external loans over the last 10 years: 2009 — EC$121 million; 2010–EC$144 million; 2011–EC$86 million; 2012–EC$104 million; 2013–EC$112 million; 2014–EC$169 million; 2015–EC$177 million; 2016–EC$178 million; 2017–EC$158 million; 2018–EC$148 million, all of which could have been financed from this new established sustainable source of income without being a burden on our taxpayers,” Leacock said.

But Gonsalves told Parliament that he has a “difficulty conceiving of citizenship as a financial matter.

“I think that to reduce citizenship to this crass trading arrangement does a disservice to citizens who have lived and died and fought in St. Vincent and the Grenadines.”

He said that Leacock continued to present CBI as “some sort of a panacea”.

“A few weeks ago, I was amused when he suggested that if we have CBI all the high school, all the secondary schools, maybe all the primary schools in St. Vincent and the Grenadines could have a track. Because, wave your citizenship wand and everybody get everything.”

He said that the premise of the question was that “apparently, if we wave the CBI wands, we won’t need to take out loans…

“So imagine my surprise when I see in the Antigua and Barbuda estimates for 2017, a country that has CBI … they have a bonds of 195 million, $66.9 million in CDB loans, and other loans and advances of $22.9 million.

“I don’t know why they didn’t wave their wand.”

Gonsalves said that in St. Kitts, in the 2017-18 budget, there are treasury bonds of $85 million, $257 million in bonds and other borrowing.

“I don’t know why they didn’t wave their citizenship wand. And the reason, as we well know, is that the majority of those countries have been spending their windfall on recurrent expenditure, not capital expenditure.”

The finance minister further said that what is budgeted is not what is borrowed in SVG because of implementation, human resources and issues.

“So, to quote the number is for the casual listener to then add up all this number and say, ‘O my Lord, look at all the money that they have borrowed.”

He said that in 2009, while EC$121 million was budgeted, EC$66 million was borrowed, EC$6 million, EC$80 million less than the budgeted amount was borrowed in 2011, while the EC$54 million borrowed in 2012 was EC$50 million shy of the budgeted amount and in 2017, EC$83 million was borrowed while EC$158 million was budgeted.

Gonsalves further said that while St. Kitts and Nevis has had a CBI programme since 1984, they ran up a debt to GDP ratio of over 200 per cent and ended in 2011, after their CBI programme was mature, in the hands of the IMF.

“I don’t know why they chose the International Monetary Fund and didn’t wave their CBI wand,” Gonsalves said, adding that Grenada, which reinstituted its CBI programme in 2013, went to the IMF in 2014.

Dominica, which had CBI since 1993 went to the IMF in 2002. He added that Antigua and Barbuda went to the IMF in 2010 and instituted their CBI programme thereafter.

“So, what I see here, with the exception of St. Lucia, is a strong correlation, not causation, between the International Monetary Fund and citizenship by investment programmes…

“Under the stewardship of the former minister of finance, and the current and future prime minister, we have never had to go to the International Monetary Fund to bail us out. We have not gone to the IMF. And so, the level of urgency that has driven the decision-making processes of some of our brothers and sisters have not been felt in St. Vincent and the Grenadines,” Gonsalves said.

Fortune magazine recently reported, the 1% of the global rich spent an estimated $US 2 billion in buying citizenships. According to Christian Kalin of Henley & Partners, Switzerland, residence-by-investment programmes attract about $US 5 billion a year in foreign direct investment; and citizenship by investment another $2 US billion yearly. Both figures are increasing at 20% a year making it a whopping $7 US billion dollar industry. But what is causing an alarming growth in this industry? The Rich and wealthy want a quick solution for free movement to many countries with no visa restrictions. The fear of global crisis such as Brexit, Trump victory, Syrian crisis, Turkey attacks.

Citizenship too, though often regarded in sacred terms by Ralph Gonsalves, can be bought and sold. Over the past ten years a substantial industry has developed around and pushed forward the market for multiple citizenships. In 2012, two countries could be described as offering citizenship by investment programs; by 2016, they numbered seven, and half a dozen additional states are in consultation about adopting the tool, according to Global citizenship 2.0 by Kristin Surak.

IMF report on revenues from citizenship by investment programs, says St Kitts & Nevis has achieved impressive 11% of GDP in 2015 and slashed its debt by 64%. Portugal golden visa ARI scheme reported 2.4 billion euros (90% invested in real estate) inflows in just 4 years of running the scheme. Malta reported over 1 billion euro inflows since the inception of the citizenship scheme in the EU. Cyprus economy is slowly recovering since the 2013 banking crisis and demand for real estate is high, ever since cyprus introduced citizenship for sale scheme. Dominica recovered from the damage caused by tropical storm Erika that destroyed 90% of the country with the help of the funds from citizenship for sale program. All the countries reported boost in economic growth, employment and demand in real estate since the inception of economic citizenship programs.

But we, in SVG, also have a secret and unaccountable CBI programme long run out of he Prime Minister’s office. If you don’t believe me, just ask Dave Ames the bankrupt owner of Harlequin Hotels and Resorts.

I cannot disagree Mr. David. Camillo seems to be blowing smoke out of his backside with his prepared excuses against the program. I wonder what happens to the money with the secret CBI program of SVG? What it really comes down to is how well the moneys from this program are used. The SVG Government does not have a very good record when it comes to managing money. Combined with all the very bad economics make us financially ungovernable.Even with a better system, if the money is poorly managed it gets us nowhere.

Really appreciate the work the ULP is doing, continue to excise prudence in managing our finances.

You dunce.

Dont you know that excise means to remove something, especially something harmful, which means that are calling for the government to eliminate prudence in managing our finances.

This was no typo on your part: you simply dont know the difference between excise and exercise because, as a complete idiot, you could never exercise your brain because it was excised at your birth.

LOL Brilliant insult if I ever read one…LOL!

Observer, what planet are you living on?

All are imperfect, still jamming. Dying base, compilation of trash.

Observer, you should not drink alcohol before you write on this site. Your words make no sense at all.

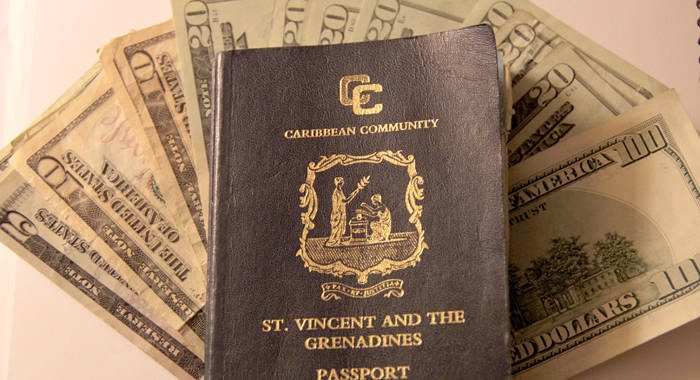

That Passport, in the photo, was not a very good choice. It looks like an old journal. Have a heart, what should people think when you publish this picture? The Passport looks really cheap.