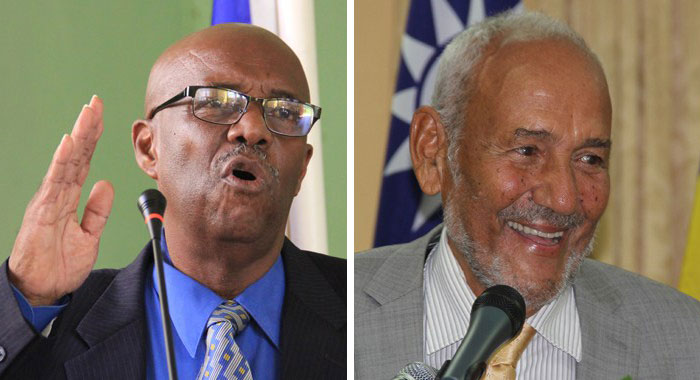

Opposition MP St. Clair Leacock says that the government should not expect the support of the New Democratic Party (NDP) in addressing the situation at the nation’s social security agency.

The National Insurance Service (NIS) must undergo reform by next year if it is to avoid “draconian changes” such as doubling contribution rate, its Executive Director, Stuart Haynes has said.

The government is seeking bipartisan support and the cooperation of other stakeholders as it seeks to implement the requisite reform.

However, Leacock, speaking on his party’s radio programme, on Wednesday, said that the government ignored the opposition’s years-long warning about its mishandling of the NIS.

He further said that the Unity Labour Party administration has ignored the NDP’s interventions on other matters of national importance.

“If they were treating us with confidence and respect in the different sets of reports, we could have been enjoined now with them to say, ‘Well, look, we’re in this thing together. Let us find the solution’,” he said.

Leacock, who is one of two vice-presidents of the NDP, said he was not outlining his party’s position.

“Now I’m not speaking out at all — because what NDP will do ultimately is beyond me. But it is not our job to bail them out because there are so many things in which they don’t want our input,” said Leacock, who is into his third five-year term as MP for Central Kingstown.

“They don’t want what we have to say on civil aviation. They don’t want to hear what we have to say on crime and violence. They don’t want to hear what we have to say on financing. ‘It’s not our business.’ But when they’re in this sticky wicket they suddenly saying, ‘Here’s an opportunity for us to come together’,” he said.

He said the situation at the NIS has partly resulted because the government has flouted the law requiring the Minister of Finance to table in Parliament actuarial reports on the NIS.

Without reform, NIS ‘projected to be depleted between 2033 and 2036’ – Finance Minister

In Parliament last week, Leacock asked Minister of Finance Camillo Gonsalves to say if there is a legal provision for the actuarial reports on the NIS to be lodged in the Parliament and if so, when the last report lodged.

He further asked Gonsalves to tell lawmakers whether it is true that the financial report on the NIS indicates that if reform is not implemented, the NIS will have to borrow funds to pay benefits in the next 15 years.

Gonsalves told Parliament that the NIS Act says, “The Board shall, with the assistance of an actuary approved by the Minister, review the operation of this act during the period ending with the 31st December 1989 and thereafter, during the period ending with the 31st December in every third year.

“The evaluation was conducted in fiscal year 2021 for the actuary to carefully consider the impact of the overlapping challenges of the pandemic and the eruption of the La Soufriere volcano on the sustainability of the fund,” Gonsalves said.

He said that after extensive deliberations between the board of the NIS and LifeWorks Bahamas Ltd., the actuary submitted the report of the 11th actuarial review of the NIS in August of 2021.

The Ministry of Finance interrogated the report, “particularly in light of the stated resolve to engage in pension reform in this year, based on the findings, results and significant recommendations in the report and previous advice from the external auditors,” Gonsalves said.

He said the NIS board engaged the Reserve Advisory and Management Partnership (RAMP) of the World Bank to conduct an independent peer review of this 11th actuarial valuation report.

“The independent peer review is not only in line with best practice, but it is prudent because the recommendations of the 11th report require the NIS to make several parametric changes to improve the financial sustainability of the National Insurance Fund,” Gonsalves said.

The finance minister said the RAMP team of the World Bank Treasury was engaged to further assess the quality of data used in the 60-year projection period of 2019 to 2079; the appropriateness and applicability of the economic, financial and demographic assumptions used in the report over that 60-year period; the consistency and reliability of the findings and results.; and, the robustness and future impact of the recommendations that are contained in the 11th report.

The RAMP team will be in SVG March 16 to 17 to conduct the technical advisory mission related to the assumptions, findings, results and recommendations of the 11th valuation report.

The minister said he anticipates and has been informed that receipt of the final report of the World Bank mission would take place no later than 60 days after this mission takes place in March.

“The cabinet would be guided by the submission of the report of the World Bank mission and the final report of the 11th actuarial valuation to make recommendations to this honourable house on parametric form of the NIS,” Gonsalves said.

He said the government will lay a copy of the final actuarial valuation report and the RAMP report of the World Bank before parliament.

The finance minister said that the last actuarial report of the National Insurance Fund was conducted as of Dec. 31 2019 and covered a three-year period from 2017 to 2019.

Gonsalves said the review conducted by LifeWorks Bahamas suggests that the current contribution and benefits provisions “provide a fairly good level of benefit adequacy and income protection to most workers and pensioners”.

The results further indicate that the fund “is not financially sustainable over the medium to long term at current benefit provisions and contribution rates.

“Therefore, if there are no further parametric reforms, or no further increases in contribution rate, the fund is projected to be depleted between 2033 and 2036,” the finance minister told Parliament.

He said that the projected depletion date existed as far back as a decade ago.

“If reserves are exhausted because of no change in contribution rate, and or benefit provisions, there will be two possible sources of additional income to meet benefit payments. First higher contributions from employers and workers and or special transfers from the government as per section 15 of the National Insurance Act.”

Gonsalves told Parliament it is important to note that the projected fund exhaustion years 2033 to 2036, that in those years the current contribution rate would only be available to cover about 60% of pension and benefits at the end of the projection period in 2079, the current contribution rate would only be able to cover about 34% of benefits and expenses.

‘Long answer’ to ‘short question’

Leacock said on the radio programme that Gonsalves’ was “the long answer is given” to “the short question that’s asked”.

He said that the minister confirmed that the government should bring the actuarial report to Parliament.

“Now, that is for good reason. It is saying that the Parliament, including the opposition … has to perform oversight responsibilities,” Leacock said, adding that is an accountability question.

“… and what the Minister is saying, having gone around the world, that even though that they have spoken about it in Parliament, they have not complied with the law, that Parliament must be able to see it,” Leacock said.

He said that the government now wants to involve the opposition in the solution to the NIS matter.

“… and they never want the opposition to be involved in anything but they want to involve us in this solution. They didn’t take Eustace’s advice in 2000 or thereabout there that you have to do something about the pension fund,” he said, referring to then Prime Minister Arnhim Eustace, who was also president of the NDP at the time.

“They went on to bring down the government over the “greedy bill” arguments, and so on and so forth,” Leacock said, referring to the political unrest that resulted from the NDP administration’s attempt at pension reform over two decades ago.

“And even though when the NDP made up their mind that they will do it, they came back and got the NDP to change. This is different. I don’t want to make some lemon orange,” Leacock said.

“In short, they now find themselves, as he is saying, that if we leave things as they are, we will be in trouble.”

He said that if no changes are made, the NIS would be able to take care of “only two-thirds — 60%” of its obligations.

“… and if we don’t do anything further, then it will get even worse, only one-third will eventually be able to take care of but the government confirmed that on the present trajectory … as early as 2033, 10 years from now, the NIS will not have enough money to pay pensioners — as early as 2033.

“But you know when you reach that stage, if you can’t pay, there is something a lot to say that if NIS can’t pay, government going pay,” Leacock said.

“Now, those are challenging economic, financial and political dynamics that the government is trying to avoid on their own.”

‘Harping back’ to Mitchell, Eustace

He said the government has a habit of harping back to the tenure of former Prime Ministers James Mitchell, who died in 2021, and Eustace under the NDP administration.

“But Eustace warned us, ‘fix this problem’,” Leacock said, adding that Eustace often expressed regret about not dealing with the pension reform issue.

“… but there Eustace was mixing up two things, though. Eustace was deal with the NIS pension, which is a contributory pension, and the government non-contributory pension to public servants where they don’t have to contribute any, which is also out of hand,” Leacock said.

“That’s another albatross around the government’s neck. They have to deal with it. Don’t come ask NDP to solve that,” he said.

He said that the NDP Is not blaming the board or management of the NIS for the actuarial reports not being tabled in Parliament.

“… they have done their work and we are acknowledging that there’s competent management in NIS at the management level. And there’s competency as well, in the board,” Leacock said

“So, the problem lies at the policymakers’ end, which are the government’s because the board forwarded the report to the government, because the board can’t bring the report to the parliament? The board could only forward it to government and governments must bring it by law.”

Well what do you expect from a LAWLESS GOVERNMENT like the U L P, sit tight N D P, it won’t be long before you get into GOVERNMENT, then you can SHOW them how to run a COUNTRY

Mr Leacock, aren’t NDP hopeful to be in Government of svg? Since you’re saying don’t come ask the ndp to help fix the issue with NiS. So I guess you personally prefer it ran amok in the meantime.At some point if you and your party gets into government it will be something you have to deal with so please make up your mind. These are part of the reason ndp stuck in the opposition for the past 5 consecutive elections with the possibility of a 6th term.